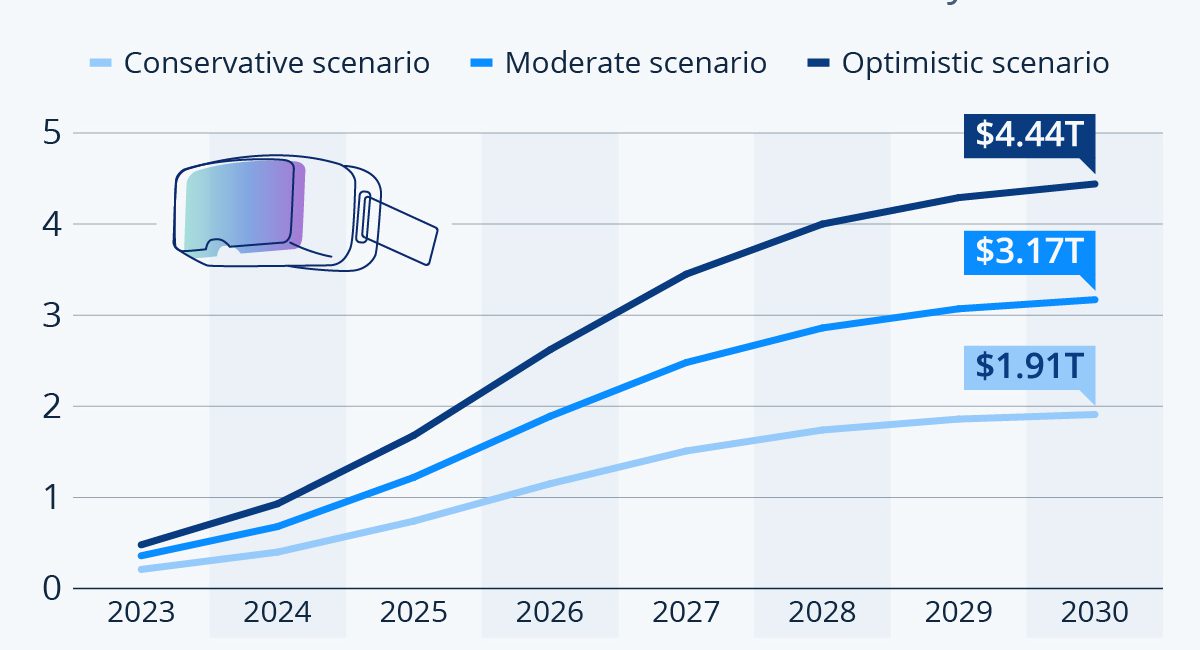

If changing the name of his company from Facebook to Meta wasn’t a big enough sign for how seriously Mark Zuckerberg is taking the potential of the metaverse, the company’s recent financial statements – revealing the billions of dollars sunk into the project so far – certainly should be. But what exactly is Meta betting on? Is there really so much potential in the metaverse to justify such massive investment? As forecasts by Statista for its Advertising & Media Markets Insights show, even looking at the conservative addressable market scenario (where 15 percent of the digital economy shifts to the metaverse), Zuckerberg is seemingly shooting for a slice of a large and lucrative pie. According to the analysis, the largest segments in terms of revenue in 2030 will be gaming ($163 billion) and e-commerce ($201 billion). By the end of the decade, the metaverse’s reach is projected to be 700 million people, worldwide, with the highest penetration rate forecast for South Korea.