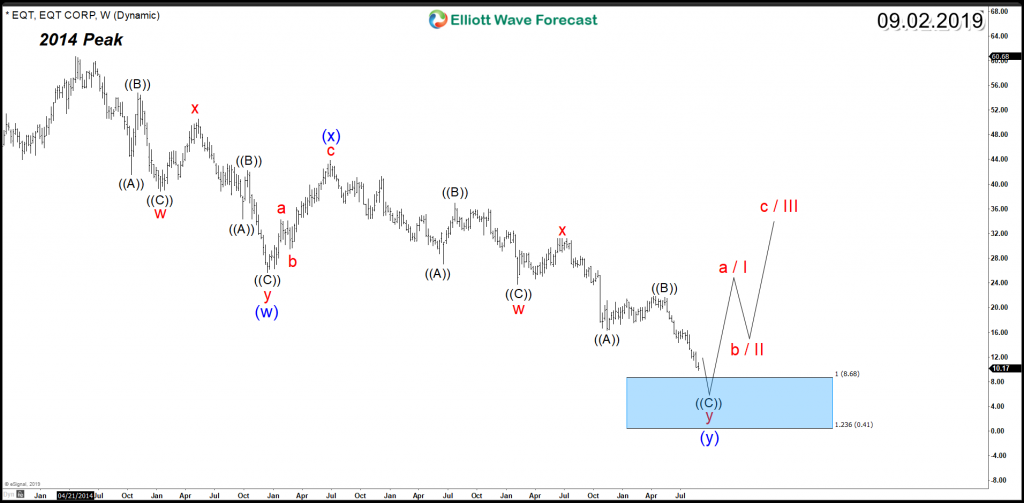

Troy Assistant Superintendent of Secondary Education Christine DiPilato talks to students in the district about what a bond is and how it works. Troy Assistant Superintendent of Business Services Rick West tells district students about the different phases of asking for and using a bond as a special presentation Feb. 7. TROY — With Troy voters’ approval of a new bond last year, Troy School District officials knew they would have an influx of funds coming into the district; they used the opportunity to show students how the bond process works in real time. On Feb. 7, the bonds were sold on the market, and high school students from around the district gathered at Athens High School to observe the sale as it was projected on a screen, seeing chunks of the bond get bought out by investors. “From the very beginning, when we knew we would have the opportunity to sell the bonds, one of the first things we talked about was how we could involve the students,” explained Superintendent Richard Machesky. “It was important to us to live up to one of our district’s core values, which was finding a way to connect our students’ learning with […]