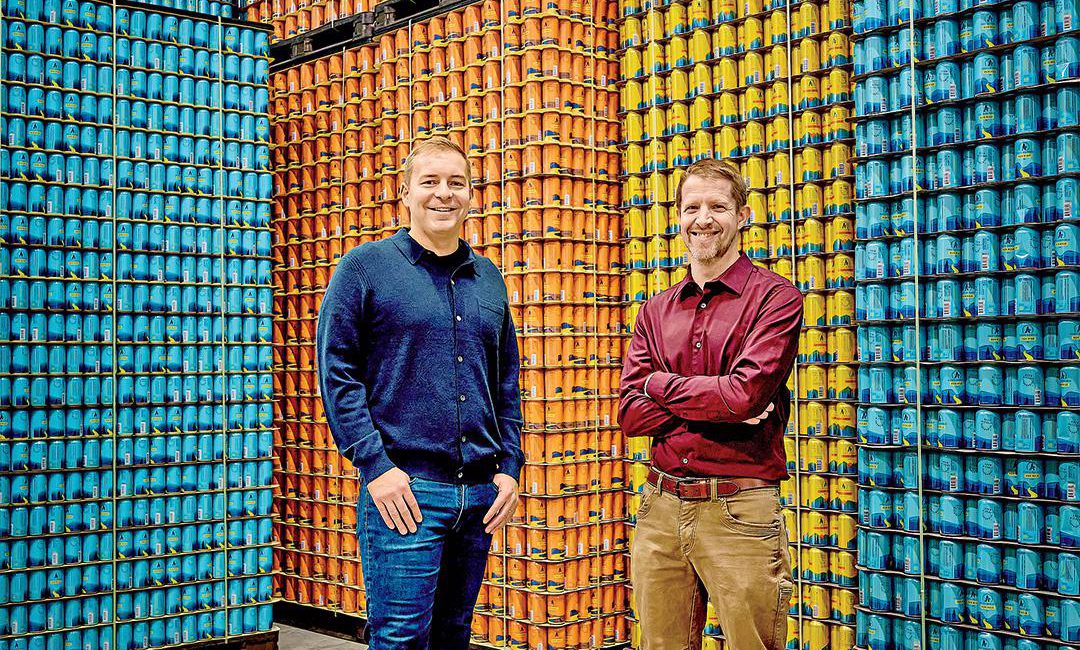

The Dry Life: Athletic Brewing cofounders Bill Shufelt and John Walker. Bill Shufelt and John Walker are making nonalcoholic beers tasty enough to please the biggest sud snobs. And with a nearly $500 million valuation, investors are intoxicated. On a dreary Wednesday in January, Bill Shufelt, the cofounder and CEO of Athletic Brewing, grabs a yellow can of golden ale off the humming conveyor belt in his new 150,000-square-foot Milford, Connecticut, brewery and cracks it open. It’s 10 a.m.—but there’s no need for an intervention. Over the last few years, Shufelt, 39, and his cofounder John Walker, 42, have created the buzziest beer brand in America by creating craft brews without the buzz. Alcohol-free beer, often bland and thin, has long been seen as the brewer’s equivalent to decaf coffee or tofu turkey. Athletic Brewing is out to eliminate the stigma, making hoppy IPAs, crisp ales and toasty porters with the flavor and feel of a craft beer—but with less alcohol than a slice of rye bread. A six-pack costs about $10. “Humans have been drinking beer for more than 5,000 years,” says Shufelt, a former hedge fund trader who, a decade ago, gave up booze to improve his […]