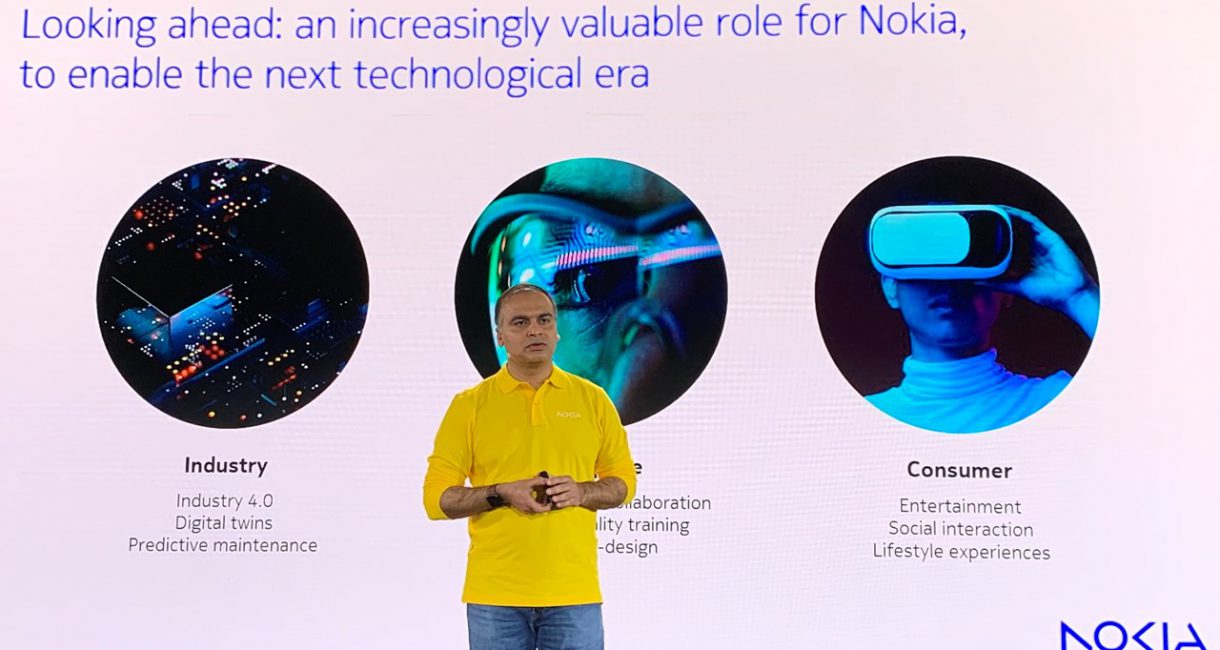

Nishant Batra, chief strategy and technology officer at Nokia, provides a business update at a pre-MWC event in Barcelona, 2023. Vendor giant sets its sights on an industrial metaverse-driven future It believes a new approach to network architecture will be needed in the next seven years Networks that can sense, think and act will be required BARCELONA – #MWC23 – Nokia believes it is in a “unique position” to capture opportunities in the industrial metaverse by developing network systems that can sense, think and act, rather than just connect. At a press and analyst briefing here on Sunday ahead of MWC23, Nokia’s chief strategy and technology officer (CSTO), Nishant Batra (pictured above), shared the company’s vision for the coming seven years in the run up to 2030 and the era of the immersive metaverse. “This is the new age of digitalisation – and in this age, there will be digitally augmented worlds, there will be solutions to different challenges and, equally importantly, there will be new business opportunities for players like ourselves”, Batra stated. In his view, as it has been playing a foundational role in building the connectivity infrastructure, Nokia now is in a unique position to grow […]