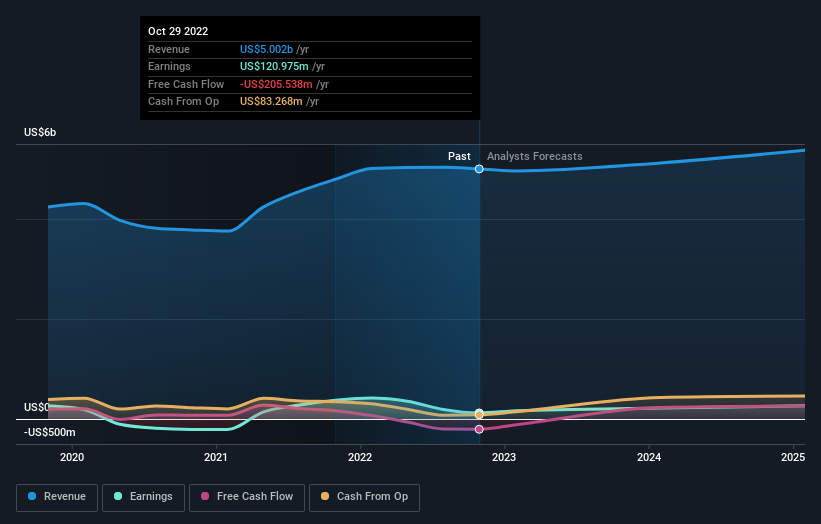

Iryna Drozd I covered Verve Therapeutics (NASDAQ: VERV ) in August 2021, when it was trading at its all-time highs. Now that it has dropped over 60%, it is time to check if this is a correction that creates an opportunity, or an exodus that should make one follow the fleet. Verve Therapeutics is a developer of gene therapies for cardiovascular diseases. It was co-founded by two well-known, highly regarded Indian origin scientists whose goal was to prevent heart attacks through once in a lifetime genetic treatments : …figure out what causes people to have premature heart attacks…a plan to discover what puts people at risk for heart attacks. Then … figure out which risk factors were actually important, before finding a way to intervene before health problems began. Verve’s goal was to find a drug whose beneficial effect on the heart: … could last, potentially, a lifetime. So far so good, and Verve did start out well with a big IPO, but it has gone down a lot from 2021. Lead asset VERVE-101 is designed to permanently turn off the PCSK9 gene in the liver, which disrupts blood PCSK9 protein production and thus reduces blood LDL-C levels. A […]