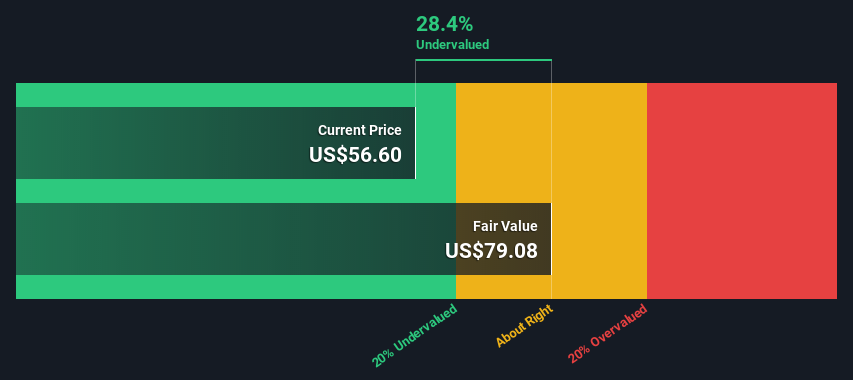

CharlieChesvick/iStock via Getty Images Coda Octopus Group (NASDAQ: CODA ) designs and manufactures high-end sea and diving visibility systems. The company has sustained a technological moat. That moat has been enhanced by adding two unique patented products significantly ahead of the competition in the last two years. Although these products are in their infancy, they promise to increase the company’s revenues and expand its market share. Although the company’s shares trade at a high multiple to average earnings, I believe this is justified by the previous successful introduction of technologies, the technological superiority of newly introduced products, and the company’s strong balance sheet. However, the company does not provide an opportunity. The growth scenario is the most probable but is already discounted on the company’s price. Note: Unless otherwise stated, all information has been obtained from CODA’s filings with the SEC . Business description Sea visibility systems : CODA develops technological systems for marine commercial and defense operations. They include imaging sonars (radars that can model what is found in the seabed), diving helmets, and positioning apparatus for ships. Marine construction companies use the company’s products to build marine cables and off-shore structures. They can also be used for […]