Turning cost centers into growth engines is the name of the game for today’s CFOs. The financial landscape is changing rapidly. Traditional payment processes, characterized by manual workflows and delayed reconciliations, no longer align with the demands of an increasingly digitized and globalized business ecosystem. Real-time data is becoming a critical driver for decision-making, and businesses are under immense pressure to reduce costs while enhancing cash flow visibility. For CFOs, these challenges have intensified as the role evolves into that of a strategic advisor. Finance chiefs are no longer just gatekeepers of budgets; they’re increasingly now orchestrators of digital transformation, tasked with delivering systems that align with broader business goals. As enterprise B2B transactions increasingly demand digitized, real-time data, businesses are under pressure to adapt , and CFOs find themselves at a crossroad: should they build an in-house solution, buy a ready-made one, or find the right partner? Each approach comes with distinct advantages and challenges, and the choice can often hinge on a company’s size, resources and long-term objectives. Read more : Silo Busting: Why Businesses Must Fix the Past to Embrace the Future The Evolving Role of CFOs PYMNTS Intelligence in the 2024 Certainty Project’s “ How […]

K&X Design and Investment Technology, LLC

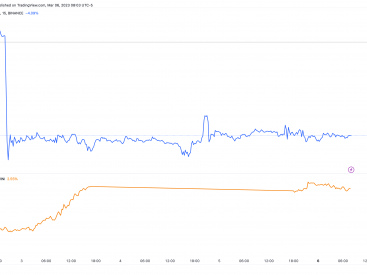

Invest The Invisible Impact

K&X Design and Investment Technology, LLC

Invest The Invisible Impact